salt tax deduction explained

During initial talks about tax reform the SALT deduction was almost eliminated. The tax plan signed by President Trump in 2017 called the Tax Cuts and Jobs Act instituted a cap on the SALT deduction.

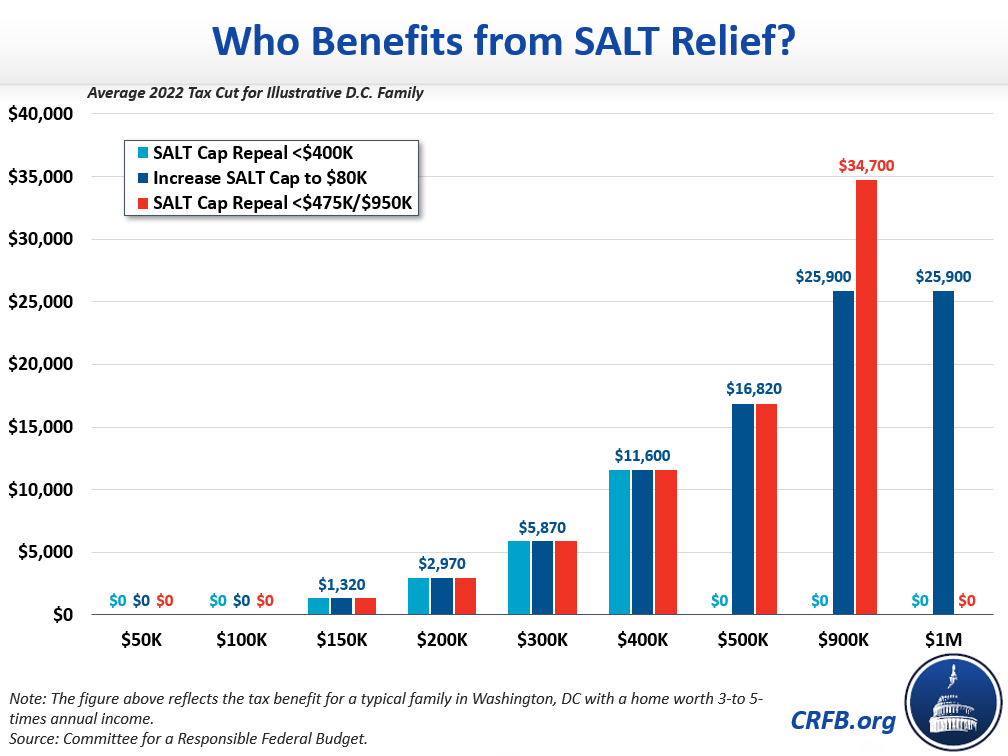

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

For anyone that itemizes their personal.

. It allows those in high-tax states to deduct the money they spend on local and state taxes. Learn More At AARP. Ad See If You Qualify To File For Free With TurboTax Free Edition.

The pre-cap SALT deduction allowed people to deduct some state and local taxes to offset federal tax payment effectively subsidizing state and local taxes for taxpayers. The taxes that can be. Capping the deduction in 2017 reduced the benefit for people who went over the 10000 limit in previous tax filings.

Conversely it also provides the federal government with. Tax Filing Is Simple And Free For Those Who Qualify With TurboTax Free Edition. The taxpayer did not receive a tax benefit on the taxpayers 2018 federal income tax return from the taxpayers overpayment of state income tax in 2018.

After legislators realized the impact of this it was decided to simply reduce the SALT deduction to 10000. Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund. 52 rows The SALT deduction is only available if you itemize your deductions.

The acronym SALT stands for state and local tax and generally is associated with the federal income tax deduction for state and local taxes available to taxpayers who itemize their deductions. More recently in 2021 it was brought up again to increase the 10000 limit. Representatives looking to adjust the deduction cap.

The SALT deduction is a tax deduction that is. Repealing the SALT deduction cap and raising the top tax rate to 396 percent would reduce federal revenue by 532 billion over the next 10 years. In tax years 2018 to 2025 the SALT deduction is capped at 10000 for single taxpayers 10000 for married couples filing jointly and 5000 for.

Just six statesCalifornia New York New Jersey Illinois Texas. SALT stands for the state and local tax deduction that taxpayers can claim when they dont take a standard deduction and choose to itemize instead. Today SALT remains a topic of conversation among taxpayers financial advisors and US.

The deduction went into effect during the 2019 tax year and included a cap of 10000. The SALT deduction also generally benefits states that have relatively large numbers of high-income taxpayers and high-tax environments. In New York the deduction was worth 94 percent of AGI while the average across all states and the District of Columbia was 46 percent.

The SALT deduction and the presence of a cap may impact state decisions about taxation. 6 Often Overlooked Tax Breaks You Wouldnt Want To Miss. The SALT deduction cap was introduced as part of the Tax Cuts and Jobs Act as a means to broaden the individual income tax base and partially fund reductions in statutory tax rates including a reduction in the top rate.

According to an explanation from the Tax Foundation SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments. The SALT deduction allows taxpayers who itemize their deductions to reduce their taxable income by the amount of state and local taxes they paid that year up to 10000. This means those that take the standard tax deduction and do not itemize their tax return are not really affected by the potential change.

Accordingly the taxpayers 2018 SALT deduction would still have been 10000 even if it had been figured based on the actual 6250 state and local income tax liability for 2018.

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

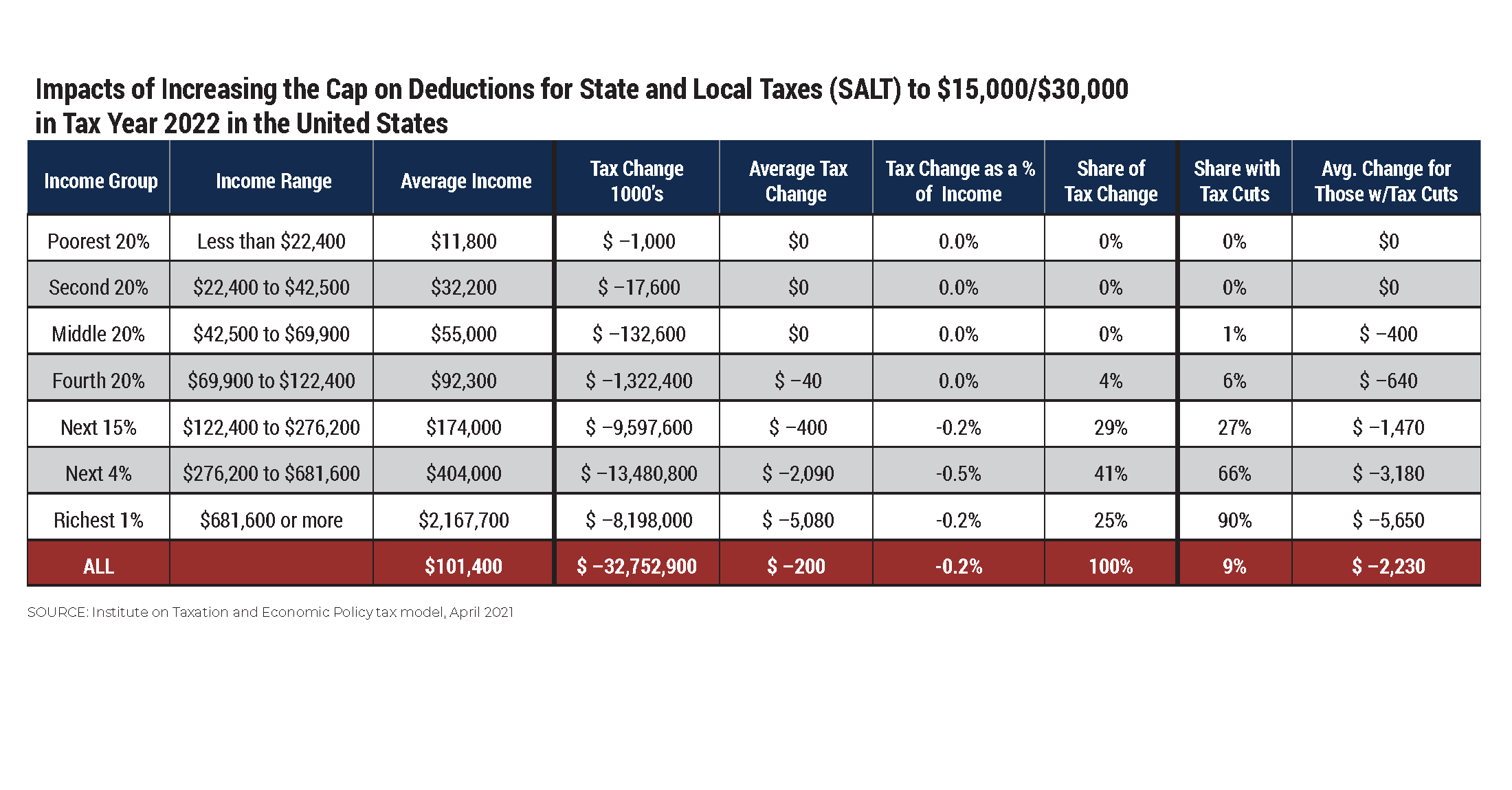

The Latest Salt Cap Fix Would Mostly Benefit High Income Households Do Little For Middle Income People

Capital Gains Tax On Real Estate 4 Common Misconceptions Money Matters Trulia Blog Capital Gains Tax Capital Gain Real Estate

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Build Back Better Salt Gains For The Rich Eclipse Child Credit Boost Committee For A Responsible Federal Budget

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

Salt Repeal Just Below 1 Million Is Still Costly And Regressive Committee For A Responsible Federal Budget

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

The Salt Tax Deduction Is A Handout To The Rich It Should Be Eliminated Not Expanded

State And Local Tax Salt Deduction Salt Deduction Taxedu

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Tax Deduction Definition Taxedu Tax Foundation

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget